Telephone 020 3813 2890 for a free no obligation chat about your regulatory requirements with one of our compliance consultants.

© Compound Growth Limited 2012 - 2020 | Terms of Use Privacy Policy

Registered in England and Wales as limited company number 07626537 - Registered Office 120 Pall Mall, London, SW1Y 5EA

We use cookies, if you consent to this use, please continue to browse our site.

Here to help with Regulation and Compliance

Barclays hit with Forex Mega Fine

21st May 2015

Barclays given largest financial penalty ever imposed by the FCA

The bank was this week given a record fine by the FCA of £284M in a combined £1.5Bn worth of fines by both UK and US regulators, following a guilty plea to criminal charges under US Anti-Trust Law.

Why Barclays was given a record fine by FCA?

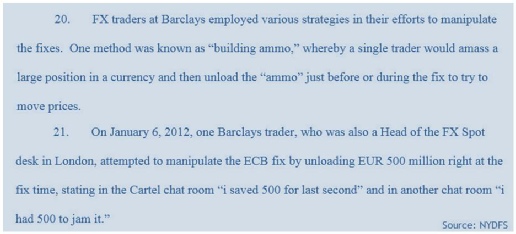

As the FCA Final Notice details, between 2008 and 2013, it was found that Forex traders at Barclays formed tightly-knit groups through controlled-entry chat rooms to manipulate exchange rates in their favour.

The bank has fired four employees, three of them based in London. It has been told to fire four more in New York and has agreed to an early settlement with the FCA thus reducing the financial penalty of £355,540,000 by 20% to £284,432,000.

During the period, the chat-room groups used various strategies to manipulate rates and also inappropriately disclosed client identities which included pension funds, hedge funds and central banks.

The overall £1.5 billion penalty Barclays received includes fines not only to the Financial Conduct Authority but also to the New York State Department of Financial Services (NYDFS), the Commodities Futures Trading Commission (CFTC), the U.S. Department of Justice (DOJ) and the Federal Reserve.

In the evidence collected against Barclays, (details of which can be found in the FCA’s Final Notice and the New York Department of Financial Services Order), shows that the FX traders exchanged information about the size and direction of their orders in online chat rooms as well as discussed the bid and offer prices banks were showing their customers, and lied to customers about orders they were executing on their behalf.

Records of the collusion suggest a number of incidences of financial crime occurred and showed the Bank’s manipulative activities and misrepresentations to customers in more than 1 million emails and recorded phone calls gathered during the CFTC’s three year investigation.

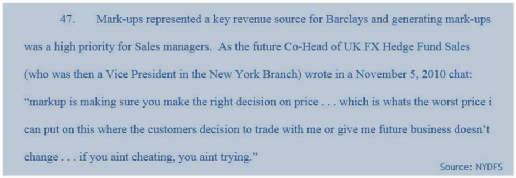

The US Justice Department also showed that Barclays had concealed mark-ups on certain transactions to customers and that these mark-ups "represented a key revenue source for Barclays" and were a high priority for sales staff. One individual working as a vice-president at Barclays at the time suggested that the maximum mark-up should be added wherever possible.

Corporate Governance Implications:

The Regulator detailed that Barclays failed to control business practices in its FX business in London. As Georgina Philippou, the FCA’s acting director of enforcement and market oversight said:

“This is another example of a firm allowing unacceptable practices to flourish on the trading floor. Instead of addressing the obvious risks associated with its business Barclays allowed a culture to develop which put the firm’s interests ahead of those of its clients and which undermined the reputation and integrity of the UK financial system. Firms should scrutinise their own systems and cultures to ensure that they make good on their promises to deliver change.”

The FCA has said that Barclays’ systems and controls over its Foreign Exchange business were inadequate and that these failings gave FX traders the opportunity to engage in behaviour that put the Bank’s interests ahead of those of its clients, other market participants and the wider UK financial system.

This behaviour included:

- inappropriately sharing information about clients’ activities

- attempting to manipulate spot FX currency rates

- collusion with traders at other firms, in a way that could disadvantage those clients and the market

What happens next?

In a press release issue by Barclays following the imposed penalties, Antony Jenkins, CEO of Barclays said “The misconduct at the core of these investigations is wholly incompatible with Barclays’ purpose and values and we deeply regret that it occurred.” He additionally added that Barclays is “committed” in “continuing work to build a values-based culture and strengthen our control environment.”

The previous Libor interest rates rigging scandal has seen 13 individuals face charges by the Serious Fraud Office, so whilst the Serious Fraud Office is yet to charge anyone over the Forex fixing, if the previous Libor rate scandal is anything to go by, individual charges are sure to follow.