Telephone 020 3813 2890 for a free no obligation chat about your regulatory requirements with one of our compliance consultants.

© Compound Growth Limited 2012 - 2019 | Terms of Use Privacy Policy

Registered in England and Wales as limited company number 07626537 - Registered Office 120 Pall Mall, London, SW1Y 5EA

We use cookies, if you consent to this use, please continue to browse our site.

Here to help with Regulation and Compliance

SM&CR: Senior Managers Functions (SMFs) - Considerations

SM&CR: Senior Managers Functions (SMFs)

7th October 2019

With time running short for solo-regulated firms looking to implement the Senior Managers & Certification Regime the deadline being 9th December 2019, we discuss one of the important elements of the SMCR regime, namely that of the Senior Managers Functions (SMFs) and some key considerations to bear in mind.

Senior Manager Functions (SMFs)

Under the SM&CR, the Senior Manager Regime (SMR) is the most high profile element, with its aim to cover only those individuals at regulated firms who have a real responsibility.

Thus the SMR sets out to be a far more focused regime that the Approved Persons Regime (APER) that it will replace.

Once implemented, those APER roles that are not becoming Senior Manager Functions (SMFs) will be covered under the Certification Regime for which firms have the responsibility for managing themselves.

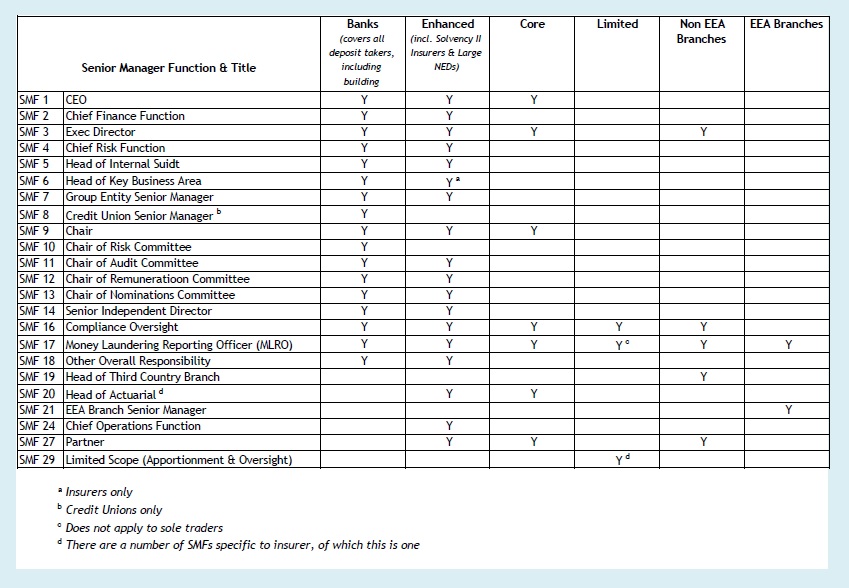

With the new regime being proportionate, firms that are bigger and/or more complex are believed to carry greater potential risks to the objectives of the regulators and are therefore required to have more Senior Manager Functions (SMFs) than those that are smaller and less complicated. Hence the reason that Banks are required to have the highest number of SMFs under the new regime, followed closely by those firms that fall under the Enhanced SMCR category. Below this, those firms that fall under the Core SMCR regime, the number of SMFs falls significantly.

This you can see in the table below that sets out the SMFs that apply to different types of firms. Remember that all individuals holding an SMF also have a Duty of Responsibility.

Table: Senior Manager Functions (SMFs) Applicable to Different SM&CR Categories of Firm

SMFs: Considerations

When firms are considering the details of each SMF role and mulling over how best to implement them, they should bear in mind the following:

The Workplace Lifecycle & Hand-overs

In many workplaces, important matters do not necessarily remain the responsibility of the same person through the course of their workplace lifecycle. Often they pass between staff as the responsibilities become better understood, senior staff mature or a new approach is required. However, when responsibilities move between individuals, a common issue is that they do not always retain the same level of priority for one reason or another, often it is because the other person has their own priorities or because the importance of the responsibility has not been fully understood or explained. Thus the transition of passing responsibilities from one individual to another is one of the key elements to successful implementation under the new regime.

Support for SMFs

Various elements of the new regime will be a big change for many individuals within the Financial Services industry. Of course, the nature of this will vary from firm to firm, however it should not be assumed that individuals, even those that have been in their roles for a long time, can carry out the additional responsibilities of an SMF without help or guidance. In addition, should the current individual within a position leave, firms might like to consider the appeal that the role may or may not present to potential new recruits.

Avoiding temptation

For some firms, there might be the temptation to have as few SMFs as possible – or at least as few as the regulations allow, however this might not always be the best choice for the firm, the individuals concerned or any future relationship with the FCA. Each firm looking to implement SM&CR will be different and having the least number of SMFs might not be the best fit with your firm’s current values and culture. In addition, choosing to do so might end up ‘downplaying’ the role that senior individuals within the firm, not including SMFs, have in ensuring regulatory compliance. Furthermore, this might place a disproportionate burden on a small number of individuals.

Stress test your model

When considering staff responsibilities and the new regimes focus upon ‘individual accountability’ your firm might be keen to ensure that there is no overlap of responsibility whatsoever. Other firms might feel the opposite and wish to avoid underlapping any responsibility, however either way, your firm should stress test your model by considering what sort of events might occur that could be deemed ‘no-one’s responsibility’ and rectify these areas of weakness.

Operation of Committees

Most committees tend to operate with some level of collective responsibility, (notwithstanding their terms of reference or who is the Chair), however this will likely need to change under the new regime below the level of the Board since the responsibility for decisions in certain areas will need to lie with an individual SMF.

Firms should therefore consider carefully about the implications for who is the Chair of your various internal firm committees, their terms of reference and how committee meetings are recorded.

Review of Incentives

Firms will need to help individual SMFs to easily understand the regulator’s new approach. One of the ways a firm can help achieve this it to align the incentives for each SMF alongside their accountabilities. Then, where an accountability that the regulator might consider significant has not been met, there should be a method in place to reduce incentive payments accordingly.

SMCR Support Services

If your firm is currently working towards implementing the new Senior Managers & Certification Regime (SM&CR) and would like any assistance in reviewing the structure or governance of your firm or ensuring your SMFs understand the Duty of Responsiblity, our team of regulatory professionals can help.

Our consultants work with clients of all sizes and complexities and can assist your firm by providing practical support, tailored training for the Senior Managers Regime, Certification Regime and Conduct Rules as well as SM&CR document templates.

Simply drop us a line with your enquiry to find out more or call for a no-obligation chat.

- SMCR for Solo-Regulated Firms: Two months to go!

- Information for Solo-Regulated Firms: Changing your SM&CR Categorisation

- SM&CR: Awaiting the Final Rules

- SMCR: Six months to go!

- SMCR Responsibilities: A Comprehensive View & Holisitic Approach

- Starting SM&CR Preparations: What you need to know

- Preparing for SM&CR: Starting Tips

- Finalised Guidance: SM&CR Responsibilities - Statements & Mapping

News & Views

News & Views

Read our latest articles, news and views affecting compliance and regulation in the UK Financial Services Industry.

Compliance Support from Compound Growth Ltd

Please contact our Compliance Support Team for a free no obligation discussion of your regulatory requirements and how our regulatory & compliance consultants can help your business move forward compliantly.

Call by Telephone:

(020) 3813 2890

SM&CR for Solo-Regulated Firms

The Senior Managers & certification Regime will apply to Solo-Regulated Firms from December 2019.

09

2019

DEC

SM&CR Key Dates

SM&CR Key Dates